Economic Incentives

Tradepoint Atlantic offers a diverse grouping of federal, state, and local economic incentives to qualifying companies and is actively engaged with the Maryland Department of Commerce and Baltimore County to identify additional incentives.

Baltimore Foreign Trade Zone (FTZ) #74

Located in or near CBP ports of entry, Foreign-Trade Zones (FTZ) are secure areas under U.S. Customs and Border Protection (CBP) supervision that are considered outside CBP territory upon activation.

- One of the largest and most active FTZ in the U.S.; ranked world’s 4th best port related FTZ

- Includes entire TPA site

- United States’ version of what are known internationally as free-trade zones – allows delayed or reduced duty payments on foreign merchandise

- Active FTZ users can store, assemble, repackage, or manufacture foreign and domestic merchandise

- TPA’s approved Alternative Site Framework (ASF) allows a company to quickly complete the activation process and locate their business

BGE – Smart Energy for Economic Development (SEED) program

The SEED Program allows qualifying businesses to reduce BGE charges for service extensions and temporarily decreases energy distribution charges.

BGE’s SEED Program offers eligible commercial customers:

- A 25% reduction on electric and natural gas distribution and demand charges

- A 75% discount on service extension costs (for businesses that are located in a Maryland enterprise zone)

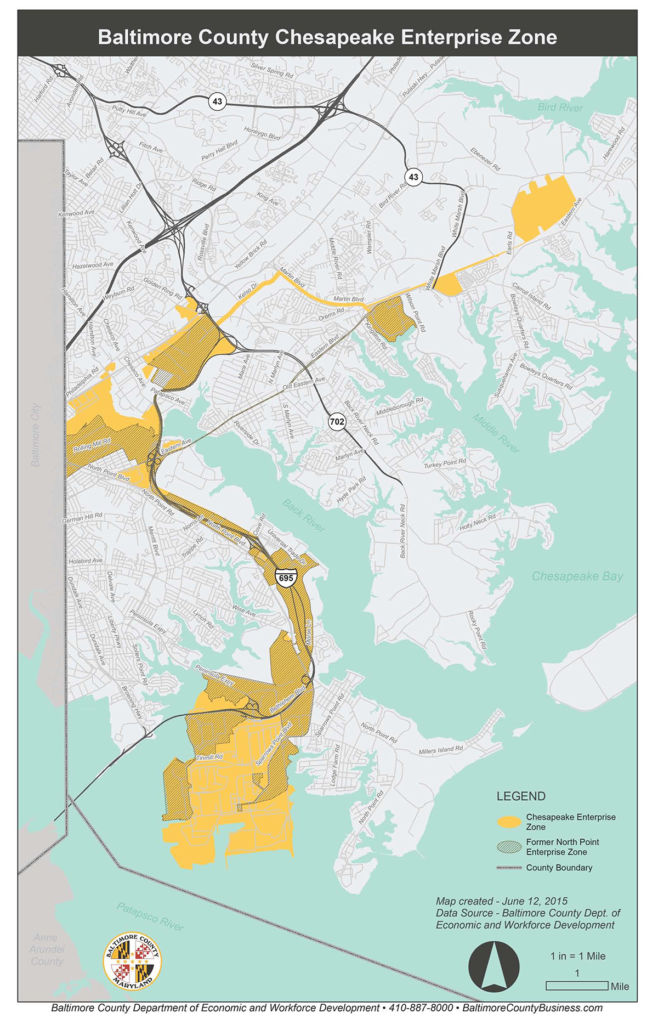

Baltimore County Enterprise Zone – Chesapeake

Baltimore County has three Enterprise Zones designated by the Maryland Department of Commerce: the Chesapeake Zone, the Southwest Enterprise Zone, and the Federal Center at Woodlawn. The zones work to support the retention and expansions of existing companies; promote development and occupancy of vacant, underutilized land and buildings; encourage the creation of well-paying new jobs; and support revitalizing older office and industrial areas of Baltimore County.

The Real Property Tax Credit – Eligible companies that make improvements to real property in the Zone can benefit from property tax credits over a 10-year period.

The State Income Tax Credit – Eligible companies located in the Enterprise Zone can benefit from a state income tax credit for newly hired employees.

The BGE “Rider 7” Electricity Price Reduction Program – Price rate reductions are available through BGE on new or incremental electricity load increases of 200kW or more per month, for companies that increase employment by at least 10 full-time equivalent persons.

Sales And Use Tax Exemption on Construction Materials / Equipment

Qualifying businesses can take advantage of Maryland state sales and use tax exemption of 6% on construction materials, warehousing, and manufacturing equipment.